In 2024, folks around the globe will head to the polls with national elections slated to occur in countries representing 40% of the world’s population.1 The decisions made by our elected officials can significantly impact our daily lives, often resulting in laws directly affecting us. With such high stakes, it’s no wonder that national elections stir such powerful emotions. However, when it comes to investing, emotions and data rarely mesh well. So, let’s take a step back from the partisan fervor for a moment and let the data guide us through some common investing questions in an election year.

Are Election Years Bad for Markets?

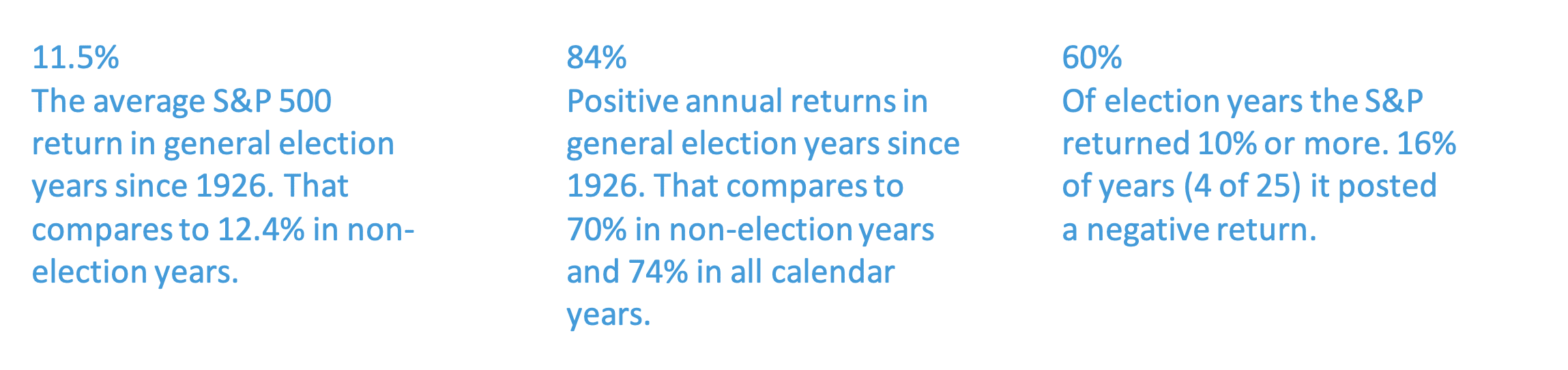

Not really but let’s dive deeper. Since 1926, the average annual return during an election year is about 11.5%.2 Interestingly, 84% of the time the S&P has posted a positive return in general election years.2 If we stopped here, we would call that a pretty good year. However, when compared to non-election years, the S&P returned 12.4% on average, but only 70% of those years were positive. 2 A modest argument could be made for either “good” or “bad”. Statistically speaking, they’re very similar. Plus, making a market prediction based on the four-year election cycle alone is akin to Punxsutawney Phil’s shadow-based weather forecast – it’s not particularly accurate.

1Strategas Washington Policy as of January 2, 2024. 2Strategas Washington Policy as of January 2, 2024&P 500 returns since 1926. Wikipedia Party Divisions since 1789.

Source: S&P 500 returns since 1926. Wikipedia Party Divisions since 1789

What Do Elections Tell Us About the Market/Economy?

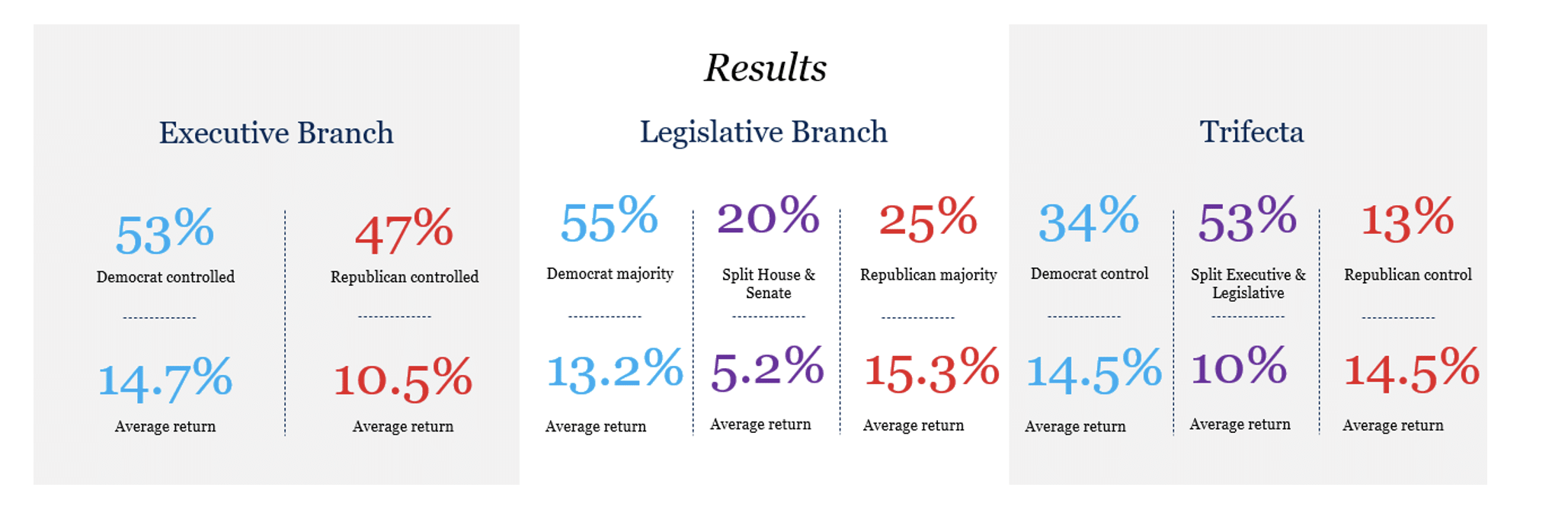

Surprisingly little. Elections are primarily focused on securing votes and making promises rather than enacting policies and legislation. Historical data suggests that markets have thrived under the governance of both political parties, indicating a relatively small divergence in performance between “blue” and “red” governed years. However, it’s essential to recognize that such data can be selectively presented to serve specific agendas, since factors like the chosen time period and overall economic conditions can be manipulated. Ultimately, profits remain impartial to political affiliations over the long run. Simply put, basing investment decisions solely on political agendas offers little tangible benefit.

Source: Wikipedia Party Divisions since 1789. Return is average return of large cap US stocks since 1926. Trifecta defined as one party controlling the executive branch, House of Representatives, and the Senate.

What Does the Market/Economy Tell Us About Elections?

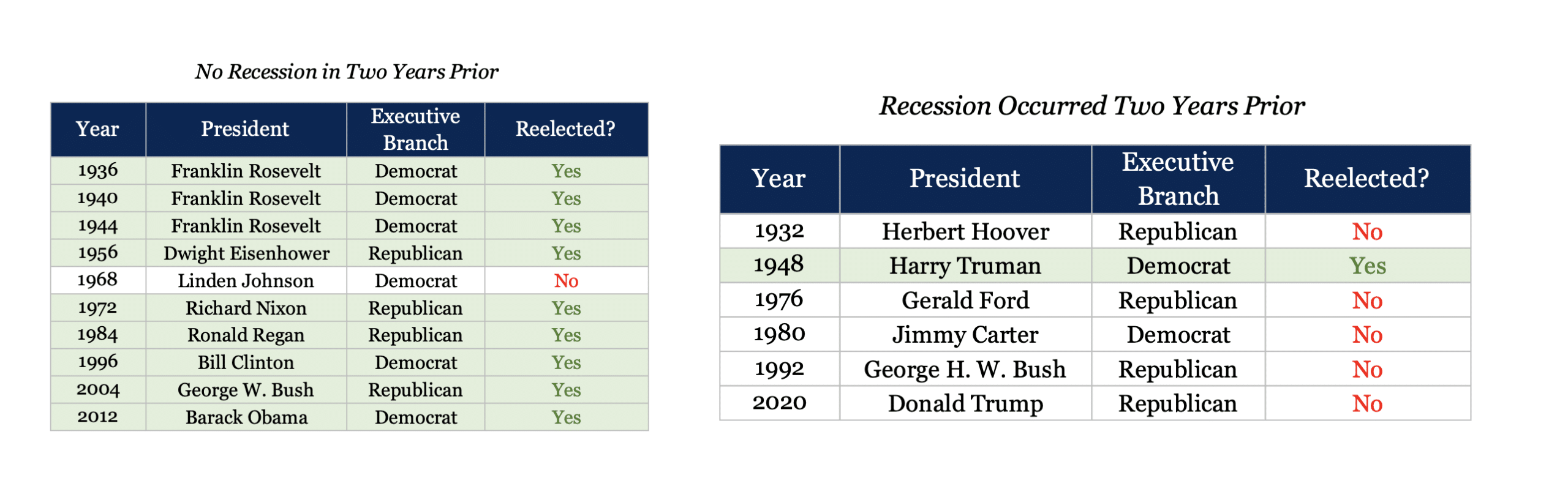

More than you may expect. As James Carville, campaign strategist for Bill Clinton, famously said, “It’s the economy, stupid.” He was right. The economic landscape during a sitting President’s term frequently shapes their perceived success. Since 1926, 16 incumbent Presidents have sought reelection. Among them, 10 ran for reelection without a recession occurring in their final two years. Of those, nine were successful in securing another term.

Source: Wikipedia Party Divisions since 1789. Return is average return of large cap US stocks since 1926 Recession dates based on the National Bureau of Economic Research.

Conversely, of the six Presidents who ran for reelection amid a recession, only one managed to make the grade. Additionally, years in which a sitting President sought reelection have also proven to be more favorable for markets. Reelection years, as opposed to open years, outperformed on average by 5.7%.3

3Return is average return of large cap U.S. based on Wikipedia Party Divisions data since 1789.

As we head into the coming months, we’ll be bombarded with campaign rhetoric aimed at stirring emotions to drive action in the voting booth. Elections rarely dictate market outcomes, and, more importantly, markets often find a way to preserve, regardless of election results.

To learn more, connect with your dedicated financial advisor, email us at [email protected], or schedule an introductory meeting here.

Disclosures & Definitions

Advisory services offered through Veracity Capital, LLC, a registered investment advisor. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Material Risks

- Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.